|

The HealthSmart Focus Newsletter provides information on legislative, legal and regulatory changes affecting the healthcare industry. Focus is researched and written by Sarah A. Bittner, Associate General Counsel for HealthSmart Holdings, Inc., and is published for the benefit of our clients, partners and other interested parties. This newsletter is designed to communicate general information regarding employee benefit matters. Nothing in this newsletter shall be deemed to constitute legal opinions or legal advice. |

|

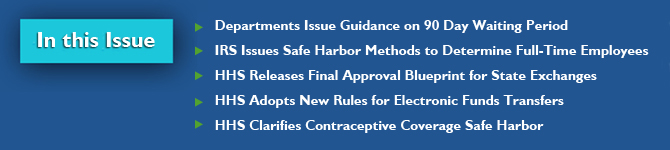

The Departments of Labor (DOL), Health and Human Services (HHS), and the Treasury (the Departments) recently issued guidance regarding the 90 day waiting period limitation under PPACA. As background, for plan years beginning on or after January 1, 2014, a group health plan or insurer is prohibited from applying any waiting period that exceeds 90 days. Clarification on Waiting Period In Technical Release No. 2012-02, the Departments define a waiting period as the period of time that must pass before coverage for an employee or dependent who is otherwise eligible to enroll under the terms of the plan can become effective. Eligibility conditions that are based solely on a lapse of time are permissible for no more than 90 days. Other eligibility conditions under the plan are generally permissible unless the condition is designed to avoid compliance with the 90 day limitation. Additionally, a plan will not be considered to have violated the 90 day limitation simply because an employee takes additional time to elect coverage. Waiting Period and Variable Hour Employees The Departments clarified that if a group health plan conditions eligibility on an employee regularly working a specified number of hours per period (or working full-time), and it cannot be determined that a newly-hired employee is reasonably expected to regularly work that number of hours per period (or work full time), the plan is permitted to take a reasonable period of time to determine whether the employee meets the plan's eligibility condition, which may include a measurement period that is consistent with the timeframe permitted for such determinations under Code section 4980H. The Technical Release also lays out several examples to demonstrate how the 90 day limitation will apply to plans. Employers and health plans may rely on this guidance at least through the end of 2014. IRS Issues Safe Harbor Methods to Determine Full-Time Employees The IRS released Notice 2012-58 describing the safe harbor methods that employers are permitted to use when determining which employees are treated as full-time for purposes of the employer shared responsibility mandate and associated penalty (the "Pay or Play" penalty). As background, in 2014, employers with 50 or more full-time employees will be subject to a penalty tax if one or more full-time employee enrolls in health insurance through an Exchange and receives a premium tax credit because: • The employer fails to offer minimum essential coverage to its full-time employees; or • The coverage offered by the employer either does not provide minimum value or is unaffordable to the employee. The monthly penalty is calculated using either the total number of full-time employees (minus 30 employees), or the total number of full-time employees receiving premium assistance through the Exchange. The Notice describes the safe harbor methods and provides clarification on the following: • Expands the safe harbor method described in previous IRS guidance to give employers the option to use a look-back measurement period of up to 12 months to determine whether new variable hour employees or seasonal employees are full-time employees. An employee is a variable hour employee if, based on the facts and circumstances on the date the employee is hired, it cannot be determined that the employee is reasonably expected to work on average at least 30 hours per week. An employee is a seasonal worker if the work is of the kind exclusively performed at certain seasons or period of the year. • Employers now have the option to use a specified administrative period (up to 90 days) for ongoing employees and certain newly hired employees to determine which employees will be eligible for coverage, and to notify these employees and enroll them in coverage • For new employees that are expected to work full-time on their date of hire, an employer will not be subject to the penalty for failing to offer coverage to the employee during the three calendar months of employment as long as the employer offers coverage to the employee at or before the conclusion of the initial three months of employment. The guidance is expected to encourage employers to continue offering health coverage for their employees by allowing the employer to adopt reasonable procedures to determine which employees are considered full-time without becoming liable for a shared responsibility payment. IRS has requested comments on this Notice by September 30, 2012. HHS Releases Final Approval Blueprint for State Exchanges The Department of Health and Human Services released the final approval process for states to apply to operate their own health insurance Exchange. States are required to submit their "blueprint" for approval to HHS no later than November 16, 2012. The blueprint must consist of a declaration letter and an Exchange application, which was made available online on September 14, 2012. Once a declaration letter is received, HHS is required to grant approval by January 1, 2013. If a state does meet the November deadline and obtain approval, a federally-facilitated Exchange will be established in that state. States will have an opportunity to receive approval from HHS in later years if their state Exchange is not approved on November 16, 2012. Many states delayed efforts to create their Exchanges while they waited for the outcome of the Supreme Court's decision on health care reform. Consequently, only a small number of states have filed declaration letters. With the November deadline quickly approaching, there is a high probability that most states will have a federally-facilitated Exchange operating in 2014.. HHS Adopts New Rules for Electronic Funds Transfers HHS recently adopted operating rules for the electronic funds transfers (EFT) and electronic remittance advice transactions (ERA) under HIPAA. Section 1104 of PPACA required HHS to issue a series of regulations over the next several years for the purpose of streamlining healthcare administrative transactions and encouraging greater use of the standards by providers. The first regulation, published by HHS on July 8, 2011, adopted operating rules to make it easier for physician practices and hospitals to determine whether a patient is eligible for coverage, as well as monitor the status of a health care claim submitted to an insurer. The second regulation, published on January 10, 2012, adopted standards for health care claim payments made via EFT and ERA. On August 7, 2012, HHS announced the third in its series of regulations. This adopts EFT and ERA operating rules that are estimated to save physician practices between $300 million and $3.3 billion over the next ten years when implemented by health plans. In addition to adding requirements for the initial set-up for electronic communications between providers and health plans, the rule set requires the following: • Health plans must offer standardized, online enrollment for EFTs and ERAs so that physician practices and hospitals can more easily enroll with multiple health plans to receive those transactions electronically. • Health plans must send EFTs within a certain number of days of the ERAs in order to make it easier for physician practices and hospitals to reconcile their accounts. HHS states that costs will be borne by health plans, with much of the benefits coming to providers. The effective date of this regulation is August 10, 2012. All HIPAA covered entities must be in compliance with the EFT and ERA Operating Rule set by January 1, 2014. Comments on the regulation are due by October 9, 2012. HHS Clarifies Contraceptive Coverage Safe Harbor HHS has recently provided clarification on the technical guidance it originally issued on February 10, 2012 related to the temporary enforcement safe harbor for certain group health plans and insurers to cover contraceptive coverage without cost-sharing. Under the guidance, HHS granted a temporary enforcement safe harbor for non-exempt, non-grandfathered group health plans established and maintained by non-profit organizations with religious objections to contraceptive coverage. In its recent guidance, HHS has clarified the following: • The safe harbor is available to nonprofit organizations with religious objections to some but not all contraceptive coverage. • Group health plans that took action to exclude or limit contraceptive coverage that was not successful as of February 10, 2012 are not, for that reason, precluded from eligibility for the safe harbor. • The safe harbor may be invoked without prejudice by nonprofit organizations that are uncertain whether they qualify for the religious employer exemption. These groups have a safe harbor until the first plan year that begins on or after August 1, 2013. Access the Focus Newsletter archives. | Visit our healthcare reform page. |